If you have lost your job and are collecting unemployment, is this a good time to file a bankruptcy case to eliminate the debts?

If you have lost your job and are collecting unemployment, is this a good time to file a bankruptcy case to eliminate the debts?

A long time ago when I was starting as a lawyer, it was unusual to see unemployed folks filing cases. It costs some money to file, of course, and that money is hard to come by without a job. People generally filed for bankruptcy when they got a new job, but realized they could never get out from under the credit card bills that had piled up while jobless.

The situation is quite different now — and he culprit is the bankruptcy reform laws passed in 2005. This law instituted a “means test” for filing Chapter 7 bankruptcy, which had the perverse effect of making the temporary poverty of unemployment an attractive time to “qualify” for bankruptcy relief.

Simply put, if you lost a good paying job, it won’t be long (three months tops) before you qualify for a Chapter 7 bankruptcy. But now, if you wait until you find a good paying job again, the US trustee could object to your discharge on the grounds that your expected future income would allow you to pay creditors a monthly tribute.

So in the current climate, filing for bankruptcy while still unemployed is a very viable strategy. You don’t have to worry about passing the means test, and you don’t (yet) have an expectation of future income that could draw an objection to your case. A topsy-turvy world indeed!

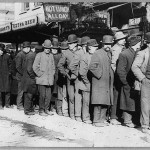

Photo: Breadlines in NYC, 1933. Library of Congress.

By Doug Beaton